First Light News: Japanese PM Takaichi nabs unprecedented victory; US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

With the LDP-led coalition securing a two-thirds ‘supermajority’ in the Lower House (352 of 465 seats) – the LDP secured 316 seats alongside its partner Japan Innovation Party – the government now wields near-total control over Japanese policymaking.

The ‘Takaichi trade’

The victory triggered a sizeable overnight market gap higher in Japan’s Nikkei 225 Stock index, pushing it to an all-time high of 57,377 and rallying about 4.0% (as of writing). The move is underpinned by Takaichi’s pro-business agenda, including an aggressive expansionary fiscal plan of around US$135 billion (¥20 trillion) and tax cuts.

The victory triggered a sizeable overnight market gap higher in Japan’s Nikkei 225 Stock index, pushing it to an all-time high of 57,377 and rallying about 4.0% (as of writing). The move is underpinned by Takaichi’s pro-business agenda, including an aggressive expansionary fiscal plan of around US$135 billion (¥20 trillion) and tax cuts.

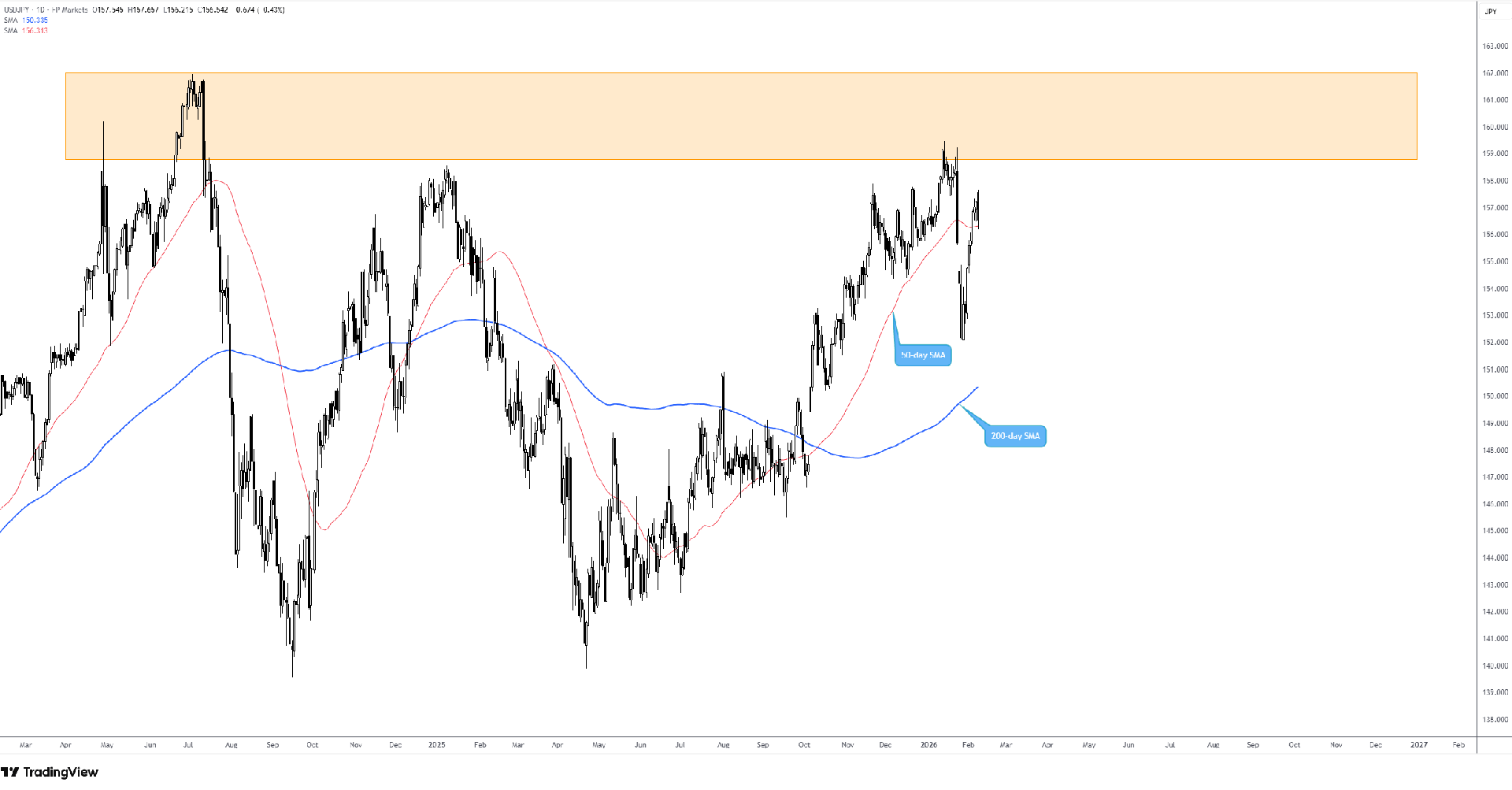

You will likely recall that this agenda triggered a sell-off in JGBs, pushing yields higher amid concerns about increased spending, with the 40-year Bond recently reaching a record high of around 4.2%. In FX, despite intervention signalling from the BoJ and the Fed rate check, the USD/JPY – despite trading moderately lower this morning (0.4%) – is essentially back where it started: near the lower boundary of the intervention zone between ¥162.00 and ¥158.00, as shown on the chart below.

Ultimately, if the Japanese PM enacts her pro-business agenda, it should theoretically weigh on the JPY – we have to consider that, despite JGB yields increasing to just north of 2.2%, real interest rates remain negative, while real US rates are positive, so the ‘carry trade’ is still in play – and potentially increase Bond yields on the back of the already high debt-to-GDP ratio.

However, as I noted above, the USD/JPY is at an interesting region, where the Ministry of Finance could intervene – this is a risk to account for in your approach to USD/JPY longs. As a result, the simplest way to trade this victory could be through buying dips in the Nikkei.

The week ahead focusses on US numbers

Undoubtedly, US economic data will command the macro spotlight this week. Although moderately delayed, the attention will be on the January US jobs report and CPI inflation numbers on Friday.

Undoubtedly, US economic data will command the macro spotlight this week. Although moderately delayed, the attention will be on the January US jobs report and CPI inflation numbers on Friday.

Ahead of these data, we have a few things to consider:

- First, we have seen a slightly dovish repricing in Fed rate-cut expectations for March’s meeting (now at 20% up from about a 10% chance just one week ago), with -50 bps of easing implied until year-end and June’s meeting almost fully priced in for a cut.

- Second, in terms of positioning, the USD remains overstretched to the downside. As such, an unwind to the upside could offer more bang for your buck, if you will.

- Third, the recent US December JOLTS Job Openings data disappointed to the downside, falling to 6.5 million (down nearly 400,000 from November). This suggests that companies are cautious in their hiring. However, the quits rate remains near historical lows at 2.0%, suggesting workers lack the confidence to voluntarily leave their jobs, reaffirming the ‘low hire-low fire’ position. Additionally, recent January US ADP data came in below market expectations at 22,000.

While I will upload a more in-depth preview ahead of this week’s events, robust jobs data (high payrolls, lower unemployment) and sticky inflation numbers would help validate the Fed’s ‘no rush’ stance and could trigger a sizeable bid in the USD, given positioning and rate pricing. On the other hand, soft payrolls (higher unemployment) and softer inflation should strengthen the case for earlier rate cuts, potentially weighing on the USD – although the reaction may be short-lived for reasons noted.

Written by FP Markets Chief Market Analyst Aaron Hill

Publication date: